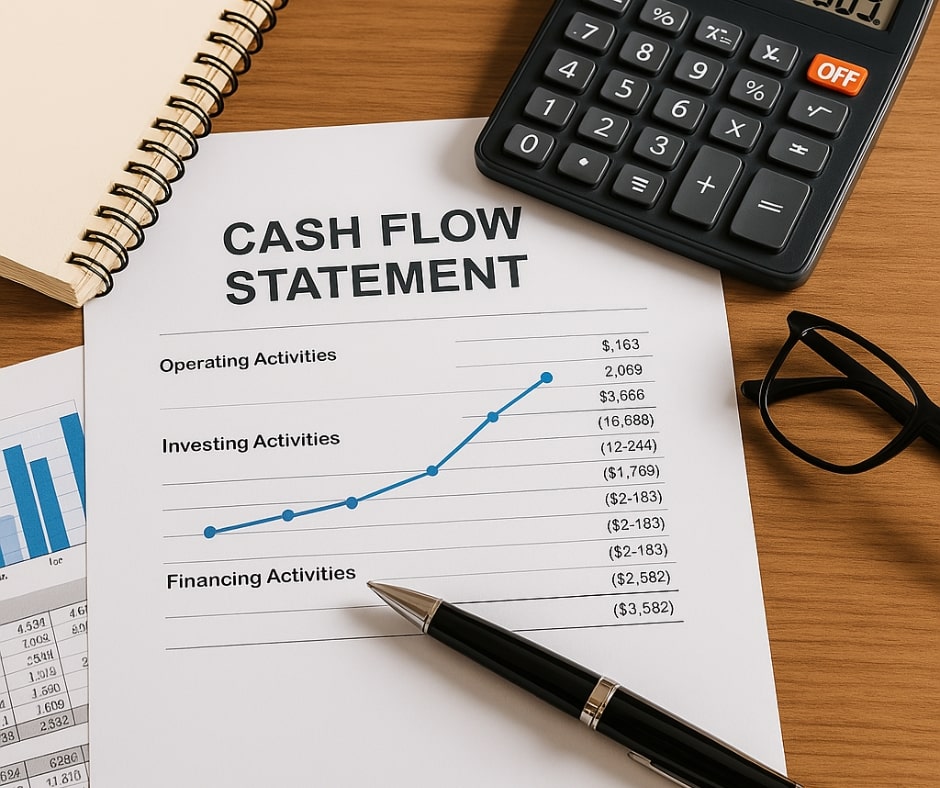

When it comes to mastering business finance, the cash flow statement is not just helpful—it’s non-negotiable. Every thriving business tracks its cash meticulously, and this document provides a real-time pulse on how cash is generated and used across all areas of operations. Without it, a business owner is essentially flying blind, making decisions based on profits without understanding actual liquidity.

💡 Why the Cash Flow Statement Is So Important

First and foremost, the cash flow statement answers one critical question: Is the business actually making money it can use today? While the income statement shows profit on paper, that doesn’t always reflect the cash available in your bank account. A business can show a net profit and still be cash-poor—or worse, heading toward insolvency. That’s why this document is invaluable.

Moreover, cash is the fuel that keeps your business running. From paying salaries and suppliers to investing in growth or surviving economic downturns, every move requires sufficient liquidity. The cash flow statement brings clarity and control to this process.

🔎 The Three Core Sections of the Cash Flow Statement

The cash flow statement is divided into three parts, and each offers specific insights into different aspects of the business. Let’s dive into each one:

1. Operating Activities: The Business Engine

This section reflects how much cash is being generated or used through core business operations. It includes revenues from product or service sales, payments to suppliers, payroll, rent, and more.

The goal here is simple: Is the business generating positive cash flow from its normal operations?

If not, it’s a red flag—even if profits look healthy on paper.

Example: A SaaS company may show $500,000 in revenue but only collect $150,000 in actual cash during the quarter. Meanwhile, it pays out $200,000 in salaries, resulting in negative operating cash flow. That can quickly lead to cash shortfalls.

By analyzing operating cash flow regularly, business owners can identify unsustainable patterns and make changes—such as shortening accounts receivable cycles or renegotiating vendor terms.

2. Investing Activities: The Growth Vision

The investing section details how the business spends money on long-term assets like equipment, technology, or real estate. It also includes proceeds from asset sales.

Positive investing cash flow often indicates asset sales, while negative investing cash flow usually shows investment in future growth. This isn’t bad—in fact, it may signal strategic expansion—but it must be balanced with overall liquidity.

Example: A restaurant may spend $80,000 on a new kitchen renovation, which will help increase future capacity and profits. However, if this investment is made without stable operating cash flow, it could stretch the company too thin.

Tracking this section allows owners to align capital expenditures with their growth strategy while safeguarding short-term cash needs.

3. Financing Activities: The Lifeline or Leash

This section shows cash movements from external financing—like business loans, investor capital, or dividend payments. It reveals how the company is funding its operations beyond internal earnings.

A business that constantly raises money to cover operational expenses is in a dangerous spot. On the other hand, strategic financing to scale operations or manage cash flow timing can be a smart move.

Example: A retail company might raise $250,000 in a low-interest loan to fund new locations. If the cash flow statement shows rising operating cash flow that eventually covers loan repayments, it’s a good use of financing. However, if operations continue to bleed cash, it’s a ticking time bomb.

This section shows whether a business is financing its growth responsibly—or patching holes with borrowed money.

📈 How to Use the Cash Flow Statement for Forecasting

One of the most powerful uses of the cash flow statement is forecasting. By analyzing historical cash flow patterns, business owners can create realistic projections for the months and quarters ahead.

This allows for proactive financial planning:

- Do you expect a seasonal dip in sales? Build a cash reserve now.

- Planning a big marketing push? Know when you’ll need the cash.

- Need to hire a new employee? Ensure consistent cash flow before adding payroll expenses.

Financial forecasting built on real cash data is far more accurate than simply using revenue projections. It puts you in control.

💬 Stakeholder Trust and Business Transparency

Beyond internal planning, the cash flow statement builds external credibility. Investors, banks, and partners often prioritize cash flow over profits when evaluating a business.

Why? Because they want to see whether you can pay your bills. A company with consistent positive operating cash flow is more attractive than one that’s profitable but cash-strapped.

Transparency in this area not only boosts trust but can also lead to better terms on loans, easier access to credit, and increased investor confidence.

🔁 Real-World Application: Improving Your Business with the Cash Flow Statement

Let’s say you run a growing e-commerce brand. You’ve had strong revenue for three quarters, but you’re always low on cash. Upon reviewing your cash flow statement, you realize:

- Your inventory costs are too high.

- Your payment processing takes too long to deposit.

- Your advertising spend is draining cash faster than you convert sales.

With that insight, you renegotiate supplier terms, switch to a faster payment processor, and reduce ad spend. The result? Your operating cash flow improves by 40% in 60 days.

That’s the real-world power of this tool.

🚀 Final Thoughts: The Cash Flow Statement as Your Strategic Compass

In conclusion, the cash flow statement isn’t just a boring accounting form—it’s your strategic compass. It gives you the information you need to:

- Make smarter decisions

- Identify and fix cash leaks

- Confidently invest in growth

- Earn stakeholder trust

- Ensure long-term survival and success

Whether you’re a seasoned entrepreneur or just starting out, embracing this financial tool can be the difference between thriving or barely surviving.

Make it a habit. Review it monthly. Forecast with it quarterly. Build your business on the solid ground of cash clarity.

✅ Ready to Take Action?

If you haven’t already, review your latest cash flow statement today. Dive into each section. Ask questions. Make one small change that improves your cash position this week.