Running a business isn’t just about selling your product or service. It’s about making sure you can sustainably grow, pay your team, reinvest in your company, and sleep well at night. The secret? A reliable 12-month cash flow projection.

This one tool has helped me plan for growth, avoid financial panic, and confidently say “yes” to big decisions — because I knew I could afford to.

Let’s dive deep into why this is essential and exactly how to do it right.

🔍 1. Revenue Forecasting: Building Your Financial Foundation

Revenue forecasting is the bedrock of a strong cash flow plan. It involves more than just guessing how much you hope to make. Instead, start with historical data. Look at the revenue from each of the past 12 months. Break it down by product or service, customer segment, or sales channel if possible.

Then, layer in forward-thinking insights:

- Do you have contracts or retainer clients? Add those first.

- Are you launching new offerings or expanding your marketing? Factor in realistic lifts in revenue.

- Is there a chance some accounts might churn? Include those risks.

Be conservative in your projections. Overestimating income sets a dangerous trap — especially when you base expenses on that expected cash. Remember, cash flow forecasting is about stability, not wishful thinking.

Pro tip: Build three versions — best case, expected, and worst case. This gives you flexibility if things go sideways.

💸 2. Identifying Fixed and Variable Costs: Know What You Have to Pay

Expenses come in two flavors: fixed and variable. Understanding this difference is essential because it helps you spot where you can cut costs — and where you can’t.

Fixed costs are expenses that don’t change month to month. These might include:

- Office rent or mortgage

- Salaried employee wages

- Insurance premiums

- Software subscriptions

Variable costs fluctuate with business activity. They include:

- Raw materials or inventory

- Freelancers or part-time help

- Shipping fees

- Utilities (if production increases, so might energy usage)

Once you list both types, plug them into your spreadsheet by month. This gives you a full picture of what it truly takes to operate — at both low and high capacity.

Here’s the insight: Fixed costs are your “stay alive” expenses. Variable costs scale with growth. Knowing both empowers you to weather storms or double down when it’s time to grow.

📉 3. Estimating Seasonal Fluctuations: Expect the Ups and Downs

Most businesses aren’t flat across the year. There are slow months. There are boom months. If you ignore seasonality, your projection will look deceptively stable — and it’ll hurt you when things dip.

Here’s how to forecast it:

- Pull in at least 2 years of past data and identify trends.

- Match sales dips or increases with seasons, holidays, tax periods, or industry-specific cycles.

- Annotate why the shifts happen — maybe it’s back-to-school, end-of-year bonuses, or weather-related patterns.

Then apply those same patterns to your projection. If sales always dip in February and spike in June, make sure your numbers reflect that.

This step helps you manage cash reserves more wisely. You’ll know when to be lean and when to go big.

📌 4. Tracking Accounts Receivable and Payable: Money In Motion Is Not Money In Hand

You could have $50,000 in outstanding invoices and still run out of money.

That’s why timing matters.

Accounts receivable is the money owed to you by clients. If your payment terms are Net-30, but you get paid 45 days later on average, you have a cash gap.

Accounts payable is what you owe to suppliers, contractors, or utilities. Understanding when those bills are due helps you stay ahead — or negotiate for more time if needed.

Build a timeline for both:

- Log when each invoice goes out and when payment is expected.

- Do the same for outgoing payments.

Include these timelines in your monthly cash flow spreadsheet. Your projection isn’t about income and expense categories — it’s about timing.

If your revenue is strong but poorly timed, your business can still suffer. This fix alone has saved me from near overdrafts more than once.

🧮 5. Using Spreadsheets or Software Tools: Start Simple, Then Scale Up

A 12-month cash flow projection doesn’t have to start with expensive software. Some of the most effective ones begin in Excel or Google Sheets.

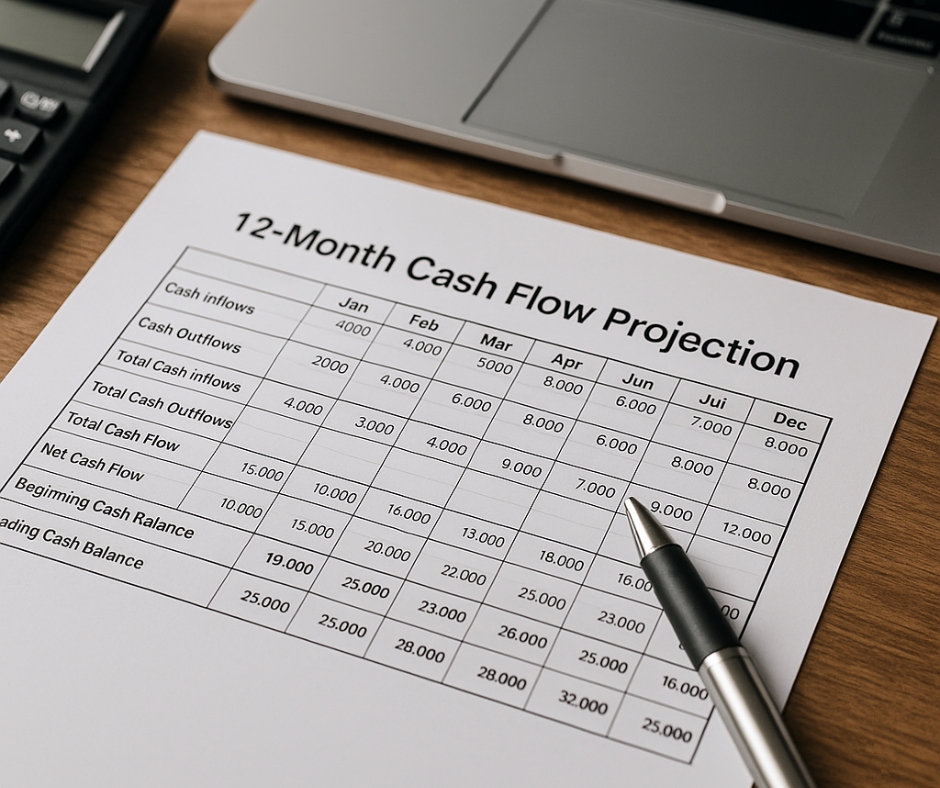

Basic spreadsheet structure:

- Columns: Jan through Dec

- Rows: Beginning cash, projected income, projected expenses (itemized), net cash flow, ending cash balance

Use formulas to automate monthly rollovers. Color code your categories. It should be easy to read at a glance.

Later, you can move to tools like:

- Float (integrates with accounting platforms)

- QuickBooks Cash Flow Planner

- Xero (with add-ons)

The right tool depends on your comfort level and business size. But never let tech delay your first projection. Start with what you know.

🔁 6. Interpreting Results and Adjusting: Stay Agile or Get Caught Off Guard

A cash flow projection is not a set-it-and-forget-it tool. It’s a living map that needs revisiting.

At the end of each month:

- Compare actual results to your projections.

- Investigate any major deviations — late payments, new costs, unexpected orders.

- Update the next few months accordingly.

This ongoing feedback loop helps you forecast with more accuracy each cycle. Over time, your predictions become sharper. You’ll make decisions faster — and with more confidence.

Also, use this projection to ask big questions:

- Can I afford to hire someone in July?

- Is Q4 the right time to launch that product?

- Do I need a line of credit to get through spring?

Cash flow is what lets you say “yes” or “not yet” to these decisions — with facts instead of feelings.

🧠 Final Thoughts: Take the Wheel of Your Financial Future

Cash flow projections aren’t just for big corporations or accountants. They’re for anyone who wants to own their business — not just survive in it.

Your 12-month cash flow projection helps you anticipate, pivot, and lead with clarity. It gives you breathing room. It gives you control.

I remember the first time I made one. I discovered I was over-spending in small but consistent ways — and they were adding up fast. By the third month of projecting, I’d made changes that freed up thousands of dollars.

So don’t wait until you’re forced to figure it out. Start now. Even if your projection isn’t perfect, it will make you more financially aware. That awareness compounds into smarter choices and bigger wins.